How to Cut Your Tax Bill with Charitable Donations

Making a charitable donation tax deduction part of your year-end planning is one of the most rewarding ways to give back to vulnerable communities while also supporting your financial goals. When you contribute to qualified nonprofit organizations like Embrace Relief, your generosity doesn’t just make a difference in people’s lives — it can also help lower your taxable income. Understanding how a charitable giving tax deduction works allows you to maximize both the social and financial impact of your support.

The tax benefits of charitable donations can be significant. Whether you’re giving cash, property, or other assets, many forms of charitable gifts tax deduction qualify for federal and sometimes state tax breaks. By keeping good records and ensuring your donations go to eligible 501(c)(3) organizations, you can reduce your tax liability while helping those in need. It’s a win-win situation: you make a meaningful contribution, and you may receive a tax donation deduction that rewards your generosity.

As the year comes to a close, here are five critical things to think about as you review your giving strategy and plan ahead to take advantage of available tax breaks for charitable donations:

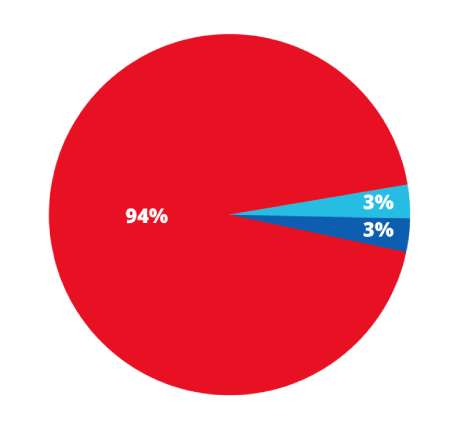

1. Understand the Deduction Limits: For 2026, the IRS allows you to deduct up to 60% of your adjusted gross income (AGI) for cash donations to public charities. If your contributions exceed this limit, you can carry forward the excess amount for up to five years. Understanding and utilizing these laws can empower you to make a significant impact while reducing your tax bill.

2. Know The Impact Of New Tax Laws: New legislation passed in 2025 may affect how much of a tax deduction you will receive after making a charitable contribution. For example, itemized charitable contributions will be capped at a 35% tax benefit beginning in 2026 (down from the current 37%); if you are a high earner, you may see more reward from making a large charitable contribution before Dec. 31, 2025, rather than after.

Tax laws can be complex, and it’s always a good idea to consult with a tax advisor to ensure you maximize your deductions and comply with IRS regulations. This can provide you with the peace of mind that you are doing everything correctly and ethically.

3. Donate Appreciated Assets: Instead of donating cash, consider giving appreciated assets like stocks or real estate. This way, you can avoid paying capital gains tax on the appreciation, and you can deduct the total fair market value of the asset.

4. Qualified Charitable Distributions (QCDs): If you are 70 and ½ years old or older, you can make QCDs from your traditional IRA. These distributions are not taxable and can satisfy your required minimum distribution (RMD). While you can’t claim a tax deduction for QCDs, they can be a great way to support your favorite charities tax-free.

5. Itemize Your Deductions: To benefit from charitable deductions, you must itemize your deductions on your tax return. That means keeping detailed records of all your donations and ensuring they meet IRS requirements.

6. Use Donor-Advised Funds (DAFs): DAFs allow you to make a charitable contribution and receive an immediate tax deduction while the funds are invested and grow tax-free until you decide which charities to support.

How to Donate and Cut Your Tax Bill with Embrace Relief

As you plan your year-end charitable giving tax deduction, consider making a lasting difference through Embrace Relief’s Year-End Giving campaign. As a 501(c)(3) nonprofit organization, every donation to Embrace Relief is fully tax deductible, and our Year-End Giving campaign offers you several options to make a powerful, life-changing impact on communities around the world.

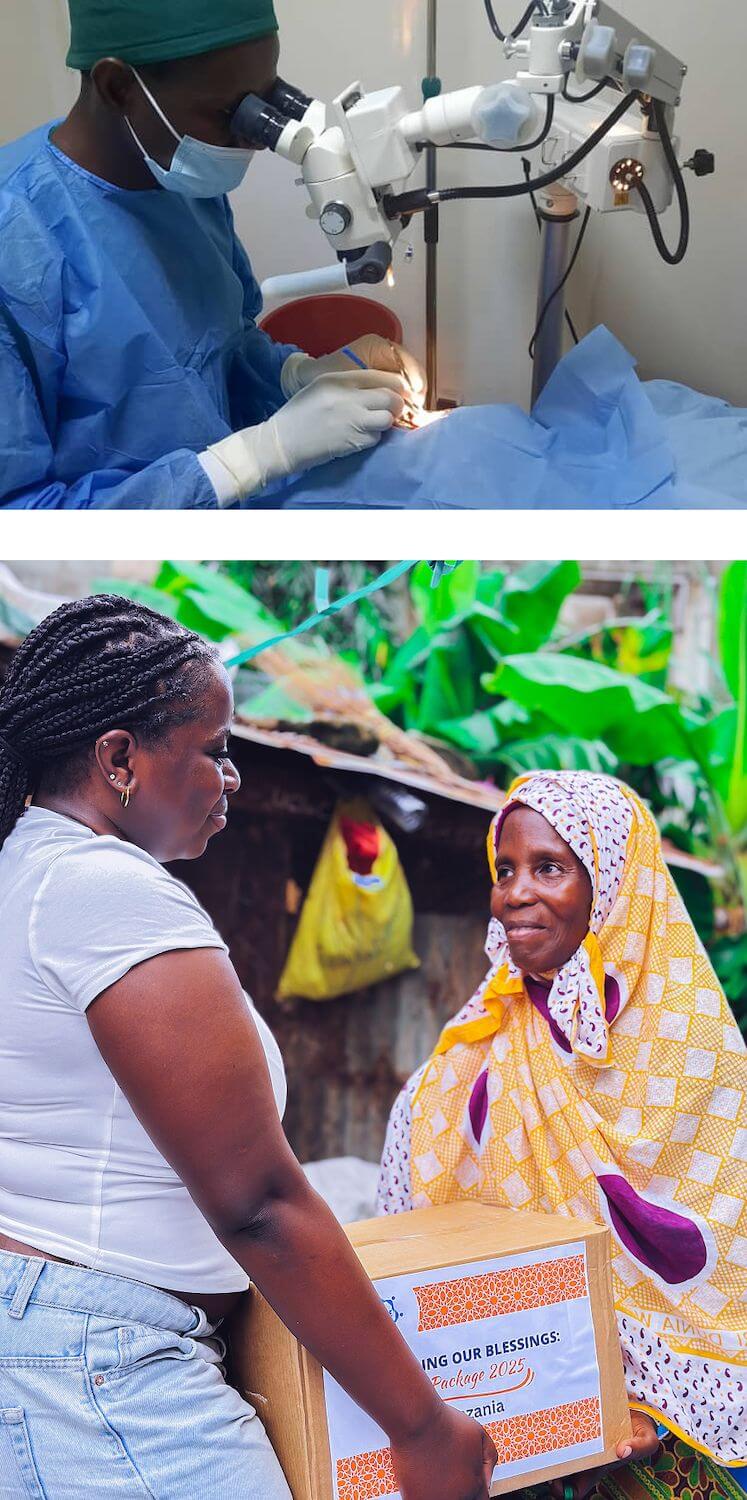

Simply visit our Year-End Giving page and select the program(s) you wish to support — delivering orphan care, building clean water wells, or providing cataract surgeries — and make your gift today. These are tangible ways your generosity can transform lives while also offering valuable tax benefits of charitable donations before December 31.

Every charitable gift tax deduction begins with a simple act of kindness — your decision to give. By donating to Embrace Relief, you ensure your gift reaches people in need across the globe, while you may qualify for meaningful tax breaks for charitable donations on your next return. It’s a powerful reminder that compassion and smart financial planning can go hand in hand.

Now is the time to take action. Make your tax donation deduction count by giving to Embrace Relief today. Together, we can close the year with purpose — uplifting children, families, and communities worldwide, while you enjoy the peace of mind that comes with knowing your generosity is both impactful and financially rewarding.