Donors looking to gift securities may realize these benefits if they itemize when filing taxes, if they have held shares of stock for at least one year and one day, and if that stock has appreciated in value since being acquired. Under these conditions, you may deduct charitable stock donations up to 30% of your adjusted gross income on your next tax return.

Why are Stock Donations More Beneficial Than

Cash Donations?

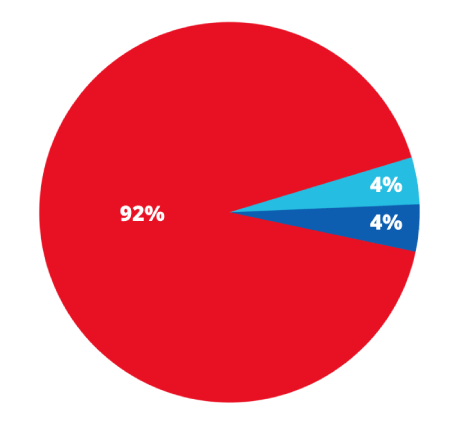

If you have had a profitable year in the stock market, you might seek to sell some of your shares and donate the proceeds to support a good cause, such as one of Embrace Relief’s eight humanitarian relief programs. However, you should consider that you will pay capital gains taxes on your sold shares. This has two negative effects: you will only be able to deduct the post-tax value of the gift from your taxable income, and it means that your charity of choice is not receiving the full value of your sold shares.

The U.S. tax code currently incentivizes donors like you to directly gift shares of stock to 501(c)(3) nonprofit organizations like Embrace Relief. By doing so, you will not face capital gains taxes, and you will be able to deduct the full market value of your shares. Once the shares are received by Embrace Relief, we sell them immediately: due to our nonprofit status, we pay no capital gains taxes on the proceeds, meaning your entire gift can be used to help people in need.

Our Stock Donation Policy

We have developed a stock donation policy at Embrace Relief for donors to have confidence in our handling of their generous gifts. The key components of our policy are as follows:

- We will accept stock donations in electronic and physical certificate forms. It is preferred that donated stock be in publicly traded companies.

- We will liquidate stock donations on arrival in order to appreciate their full value.

- Embrace Relief’s account will keep at minimum the necessary funds to allow for donations and sales of stock.

- It is the responsibility of donors to notify Embrace Relief of their intent to donate stock by using the form at the bottom of this page. This is essential: without your notification, Embrace Relief will be unable to identify your gift as a stock donation when it is transferred to our account.

- After Embrace Relief is notified of your stock donation and has received the transfer, we will provide a donation receipt for your own records, which you will be able to submit with your tax return.

- On the notification form, donors may indicate which Embrace Relief program(s) they would like their stock donation to support. If no program is indicated, Embrace Relief reserves the right to direct the gift to the program it deems most in need.

- There is no minimum amount or maximum limit for stock donations.

Donate your stock to Embrace Relief today!

We have provided a step-by-step guide to ensuring an easy, efficient and donating stock to Embrace Relief, click here.Thank you for supporting our global humanitarian mission! If you have any questions about the process, please call +1 (201) 528-3181, or email [email protected].

After making your stock donation

Once you have transferred your stock to Embrace Relief, please use the form below to notify us of your donation, and to indicate which program(s) you would like your donation to support. Filling out this form is essential so that we can provide a receipt for your records. Unless the form is completed, your identity will otherwise not be shared with Embrace Relief, and we will be unable to provide proof of your tax-deductible donation.