Give smarter, save more, and make a lasting impact.

As the year comes to an end, many families and individuals begin thinking about how to give back — and how to give wisely. While writing a check or making a one-time donation is meaningful, there’s a smarter way to multiply your impact while saving on taxes: donating stocks instead of cash.

By making a stock gift, you can avoid capital gains tax, qualify for a charitable deduction, and help Embrace Relief reach more people in need — all with the same generosity you already planned to give.

Why Smart Giving Matters at Year-End

The final months of the year are when most charitable contributions are made. It’s a season of gratitude and reflection — and, for many, it’s also the right time to review finances and tax strategies.

When you donate appreciated stocks or securities you’ve held for more than a year, you give without triggering capital gains tax. That means your chosen charity — whether you’re supporting clean water donations, sponsoring cataract surgeries, or contributing to our orphan care program — receives 100% of the value, and you keep your tax savings.

This isn’t just smart financial planning — it’s a strategy that allows you to give more without spending more.

How Stock Donations Work

When you sell stock, you normally pay capital gains tax on the increase in value from the time you purchased it. But when you donate that same stock directly to a qualified nonprofit, such as Embrace Relief, you can bypass that tax entirely.

Here’s how it works in simple terms:

- You transfer shares directly from your brokerage to Embrace Relief’s charitable account.

- Embrace Relief sells the stock immediately upon receipt — tax-free.

- You receive a charitable deduction equal to the fair market value of the stock on the day of transfer.

You save on capital gains tax and reduce your taxable income — while the charity benefits from the full stock value.

For example: If you bought stock for $1,000 that’s now worth $3,000, donating it saves you from paying tax on that $2,000 gain. If you were to sell it, you could owe hundreds in taxes — but donating means every dollar goes to supporting programs that change lives.

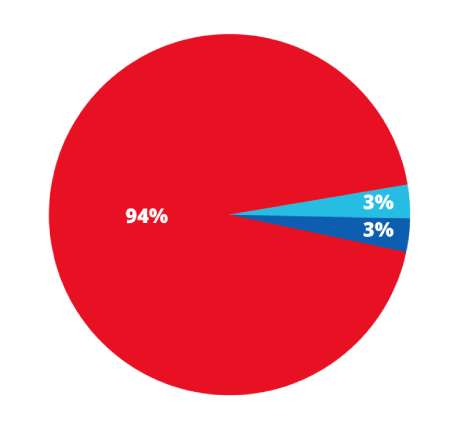

Why Stock Gifts Are a Win-Win

A stock donation benefits both the donor and the cause. It’s simple, efficient, and maximizes impact without added costs.

For donors, the advantages are clear:

- Avoid capital gains tax: No tax owed on appreciated value.

- Full deduction eligibility: Claim the full market value as a charitable contribution.

- Simplified giving: Transfer directly from your investment account — no complex paperwork.

- Bigger impact: The charity receives more funds than it would from an after-tax sale.

For Embrace Relief, it means more resources to fund programs like clean water access, cataract surgeries in Mali, and orphan care initiatives across Africa and Asia.

It’s a partnership where generosity meets financial wisdom — and everyone wins.

Integrating Stock Giving into Your Year-End Plan

As you review your portfolio and charitable goals this December, consider donating appreciated stocks before December 31 to maximize your year end giving benefits for the current tax year.

This can also be an ideal teaching moment for families. Explain to younger family members how investing and giving can go hand-in-hand — that generosity doesn’t just come from what we earn, but from what we grow and choose to share.

Turn it into a family tradition: review your investments together, identify appreciated assets, and decide as a family which cause — water, vision, or child welfare — will benefit this year. Each stock gift becomes part of your family’s story of giving back.

How to Make a Stock Donation to Embrace Relief

Making a stock donation is simple. You or your financial advisor can:

- Contact Embrace Relief for transfer instructions.

- Complete the stock donation form with your brokerage.

- Notify the Embrace Relief team so they can properly identify and acknowledge your gift.

Once your stock is received and sold, you’ll receive a confirmation and tax receipt for your records. It’s that easy — a few clicks to turn your portfolio gains into global good.

Give Smart, Save Smart, Change Lives

Donating stocks is one of the most tax-efficient ways to give — and one of the most powerful ways to support the causes you care about.

Whether your heart is set on restoring sight in Mali, bringing clean water to communities in need, or caring for orphans around the world, your stock gift can help make it happen — while reducing your tax burden and increasing your impact.

This holiday season, give smarter. Let your investments do double duty: growing your portfolio and growing hope across the world.

Avoid capital gains tax. Give smarter. Change lives.

Contact Embrace Relief to Make a Stock Gift