As Ramadan approaches or the end of the year nears, many Muslims begin reflecting on their charitable responsibilities. Giving becomes more intentional, questions surface, and one common concern arises again and again: Can Sadaqah count as your Zakat payment?

At first glance, the two may seem similar. Both involve charity, generosity, and helping those in need. But while Sadaqah and Zakat are closely related, they are not the same—and understanding the difference is essential to fulfilling your obligations correctly.

In this blog, we’ll explain what Zakat and Sadaqah are, how they differ, when Sadaqah can or cannot count as Zakat, and how to give with clarity, confidence, and purpose.

Understanding Zakat: A Fixed Obligation

Zakat is not an optional charity. It is a mandatory act of worship and one of the core pillars of Islam. Every eligible Muslim is required to give Zakat once a year if their wealth exceeds a minimum threshold known as Nisab.

The purpose of Zakat is both spiritual and social. Spiritually, it purifies wealth and reminds believers that possessions are a trust, not ownership. Socially, it redistributes wealth to support those who are struggling.

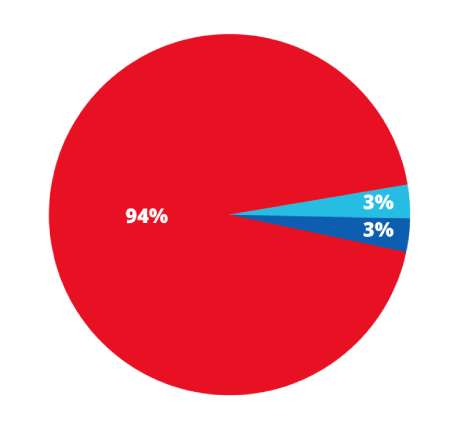

Zakat is calculated at a fixed rate generally 2.5% on qualifying assets such as savings, investments, gold, silver, and business goods that have been held for a full lunar year.

Because Zakat is an obligation, it comes with specific rules about who can receive it, how it must be calculated, and when it must be paid.

What Is Sadaqah?

Sadaqah, on the other hand, is a voluntary charity. It is not bound by a minimum amount, a specific time, or a strict calculation.

Sadaqah can be given:

- At any time

- In any amount

- To a wide range of causes

- In many forms, including money, food, kindness, or service

Sadaqah reflects generosity from the heart. It can be spontaneous, ongoing, and deeply personal. Unlike Zakat, it is not restricted to certain recipients and does not require formal calculation.

This flexibility is what often causes confusion between Sadaqah and Zakat.

The Key Difference Between Zakat and Sadaqah

While both forms of giving are deeply valued, their intent and obligation are different.

Zakat is an act of duty.

Sadaqah is an act of choice.

Zakat must meet specific criteria.

Sadaqah has no formal conditions.

Zakat is owed annually by eligible individuals.

Sadaqah can be given anytime by anyone.

Because of these differences, Sadaqah does not automatically replace Zakat—even though both involve helping others.

So, Can Sadaqah Count as Zakat?

The short answer is: Only if certain conditions are met.

Sadaqah can count as Zakat only when:

- You intend it as Zakat at the time of giving

- The recipient is eligible to receive Zakat

- The amount given fulfills your Zakat obligation</li>

- The donation meets all Zakat rules

If these conditions are not met, then the donation remains Sadaqah and does not fulfill your Zakat duty, even if it was generous or given during Ramadan.

The Role of Intention (Niyyah)

One of the most important elements in answering this question is intention.

For a donation to count as Zakat, the intention must be clear at the time of giving. You cannot give Sadaqah first and later decide to count it as Zakat.

Intention transforms an action. Without the correct intention, a charitable act—no matter how meaningful remains voluntary charity and not an obligatory one.

This is why clarity before giving is essential.

Who Can Receive Zakat (and Why It Matters)

Zakat can only be given to specific categories of people defined in Islamic teachings. These generally include:

- Those living in poverty

- People struggling with debt

- Individuals unable to meet basic needs

- Certain humanitarian causes aligned with Zakat principles

Sadaqah, however, can be given to almost anyone including family members, friends, or community projects.

If you give Sadaqah to someone not eligible for Zakat, that donation cannot be reclassified as Zakat later.

Understanding the recipient is just as important as understanding the intention.

Common Situations That Cause Confusion

Many people assume their regular charitable habits automatically cover Zakat. This is where misunderstandings often occur.

For example:

- Giving food to neighbors

- Donating to general community projects

- Supporting relatives financially

- Contributing to causes without specifying intent

All of these are beautiful acts of Sadaqah but unless they were given with Zakat intention and to eligible recipients, they do not replace Zakat.

This doesn’t diminish their value; it simply means Zakat still needs to be paid separately.

Can You Give Sadaqah and Zakat Together?

Yes and this is often encouraged.

Many people choose to:

- Pay their Zakat in full to eligible causes

- Continue giving Sadaqah throughout the year

This approach ensures obligations are met while generosity remains ongoing.

Think of Zakat as the foundation and Sadaqah as the extension. One fulfills duty; the other reflects extra compassion.

Timing Matters: Zakat vs. Ongoing Charity

Zakat is due once your wealth has remained above the Nisab for a full lunar year. It should not be delayed unnecessarily.

Sadaqah has no deadline. It flows naturally throughout the year and often increases during Ramadan or times of crisis.

Giving Sadaqah regularly is highly recommended—but it should not replace timely Zakat payments.

Why This Distinction Is Important

Understanding whether Sadaqah can count as Zakat is not about legalism, it’s about fulfilling responsibility correctly.

Zakat is designed as a structured system of support for those most in need. Its guidelines ensure fairness, accountability, and consistency.

When Zakat is replaced incorrectly with Sadaqah, this system weakens, sometimes unintentionally leaving the most vulnerable unsupported.

Clarity protects both the giver and the recipient.

Giving with Confidence and Peace of Mind

Many charitable organizations now help donors clearly designate whether a donation is Zakat or Sadaqah. This transparency ensures funds are used appropriately and according to intention.

When giving:

- Decide whether your donation is Zakat or Sadaqah

- Clearly state your intention

- Choose trusted platforms that respect both categories

This approach removes doubt and allows you to give with peace of mind.

A Practical Way to Think About It

A helpful way to remember the difference is this:

Zakat answers the question:

“What do I owe?”

Sadaqah answers the question:

“What more can I give?”

Both are acts of worship. Both are meaningful. But they serve different purposes and should not be confused.

Conclusion: Give Clearly, Give Correctly

So, can Sadaqah count as your Zakat payment?

Yes but only when it is given with the correct intention, to eligible recipients, and in accordance with Zakat rules.

Otherwise, it remains Sadaqah valuable, rewarded, and impactful but not a replacement for Zakat.

Understanding this distinction allows you to give with clarity, fulfill your obligations properly, and continue practicing generosity without confusion.

When charity is given with knowledge and intention, it brings not only relief to others but also peace to the heart of the giver.