Summary

- Muslims around the world will soon be fulfilling their Zakat obligations, donating a portion of their wealth to those most in need.

- Use this guide to find out exactly what possessions and holdings count towards your Zakat obligation, and if your personal wealth meets the Zakat threshold.

- Use Embrace Relief’s easy, free Zakat calculator to determine what you owe.

- Then, we invite you to make your Zakat donation right here in support of one of Embrace Relief’s eight international humanitarian programs.

Zakat, one of the Five Pillars of Islam, is a fundamental practice that emphasizes charity and generosity. Every Muslim adult of sound mind, who holds assets above a certain threshold, is obligated to give a portion of their wealth to those in need. Zakat is not just a form of charity; it is a compulsory act of worship and a means of purifying one’s wealth; the word Zakat itself is Arabic for “that which purifies.”

Calculating Zakat requires each person to do a thorough accounting of their income, assets and liabilities. If one’s total wealth (income plus assets minus liabilities) is greater than or equal to the Nisab, the minimum threshold for Zakat eligibility, then paying Zakat is obligatory. As of December 2023, the value of Nisab, based on the standard of 3 ounces of gold, is approximately $6,100.

If one owes Zakat in a given year, they must give 2.5% of their total wealth to poor people, or to organizations who work with the poor. Most Muslims make their Zakat donation during the month of Ramadan, but it can be done at any time of year, as long as it is given each lunar year. Donating Zakat serves as a reminder of the interconnectedness of the Muslim community and the importance of helping those less fortunate.

How do I determine my Zakat obligation for 2024?

Zakat is calculated on various forms of wealth, including savings, investments, gold, silver, and business profits. However, not all forms of wealth are subject to Zakat. Personal items such as a primary residence, clothing, and personal vehicles are exempt. Additionally, only surplus wealth, after deducting necessary expenses, is considered for Zakat calculation.

Here is a five-step process that will help you determine your Zakat obligation. We recommend using Embrace Relief’s free Zakat calculator as you progress through each step:

Determine Eligible Assets: dentify all assets that are subject to Zakat. Begin by identifying all cash on hand, including money in bank accounts, savings, and any other liquid assets. Any interest earned on savings should also be included. Next, determine the current market value of all gold and silver you own in any form, such as jewelry or coins. Then, calculate the current market value of any investments you have made, including stocks, bonds, mutual funds, or other tradable assets. Finally, if you own or part-own a business, add the value of your inventory, equipment and property.

2) Deduct Liabilities: Calculate the amount of any outstanding debts or financial obligations you owe, and subtract this total from the total value of assets from step 1. Debts and obligations can include personal loans, mortgages, and business-related debts; it also includes personal bills – such as rent, utilities, insurance, medical bills, federal and state taxes, and others – that you owe prior to the Zakat due date.

3) Calculate your Zakat: After subtracting your liabilities from your assets, if the remaining total is equal to or exceeds the Nisab ($6,100 as of December 2023), then you must give Zakat. Multiply your remaining total by 2.5% to reveal the amount you owe – or use our Zakat calculator.

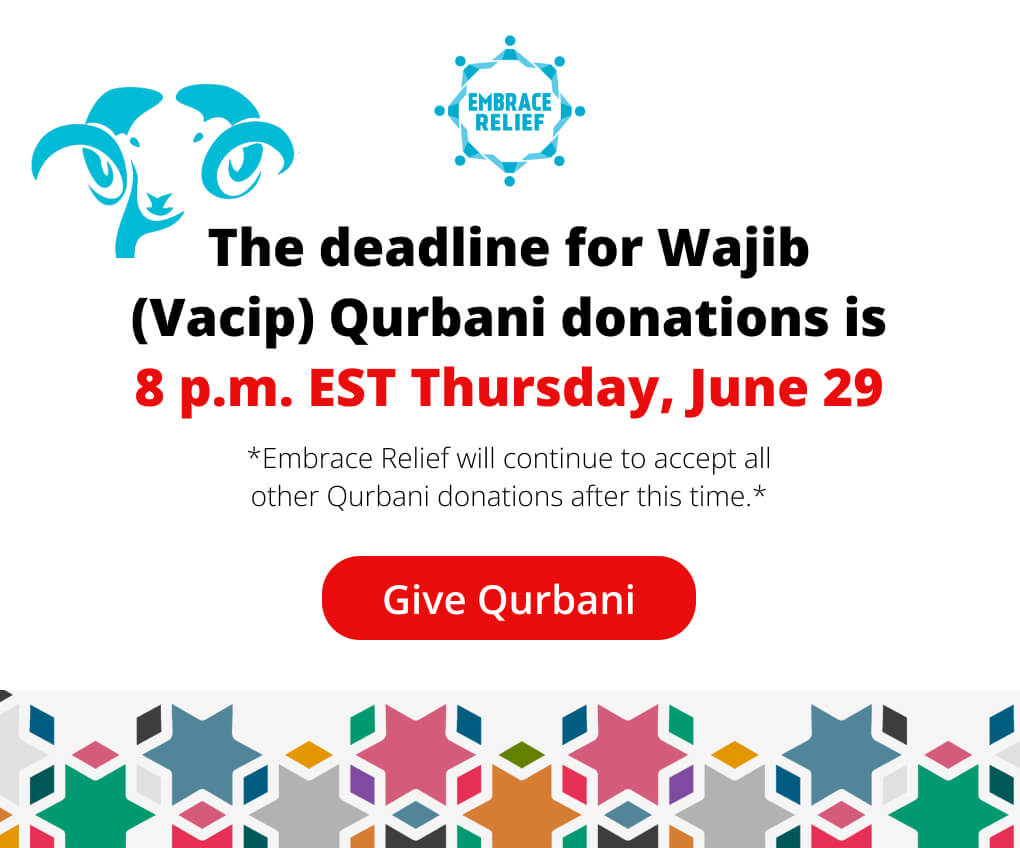

4) When to give your Zakat: While Zakat is an annual obligation that can be made at any time, it is recommended to give it during the month of Ramadan. Many Muslims choose to distribute their Zakat during this blessed month, as it holds spiritual significance and provides an opportunity for increased spiritual reward.

5) Where to give your Zakat: The Quran specifies that Zakat must be donated to one of eight specific groups of people: “for the poor and the needy and those who are in charge thereof, those whose hearts are to be reconciled, and to free those in bondage, and to help those burdened with debt, and for expenditure in the Way of Allah and for the wayfarer” (Al-Tawbah, 9:60). To put this another way, you may give directly to poor people in need, or you may give to a registered, reputable charity organization that distributes aid to the poor.

Give your Zakat with Embrace Relief in 2024

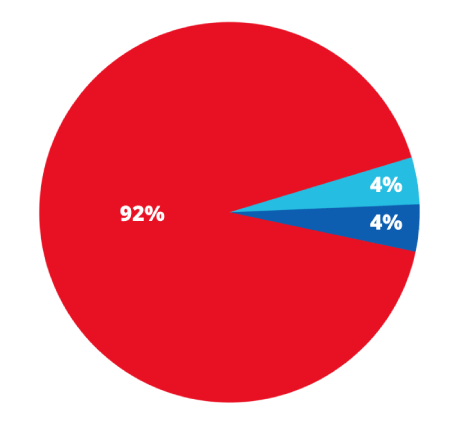

Once you have calculated your obligation, we humbly ask you to consider giving your Zakat to Embrace Relief. We are an international humanitarian nonprofit charity with a 15-year track record of providing aid to the most vulnerable communities in the world. Our eight humanitarian programs have supported more than 7 million people since 2008 by providing food, water, disaster relief, healthcare, education, shelter and more in dozens of countries.

Paying Zakat is a sacred obligation, a fundamental pillar of Islamic faith that fosters compassion and solidarity within our communities. At Embrace Relief, we deeply understand the sanctity of this duty and the significance of your financial contribution. We assure you that your Zakat will be handled with utmost care, transparency, and responsibility, and that every penny you give will be directed towards aiding people most in need.

Click here to learn more about Embrace Relief’s dedicated programs that continue to help people every single day. Click here to use our free Zakat calculator and donate.

Your generosity will empower Embrace Relief to continue to make a meaningful impact in the lives of those less fortunate, as we continue to support communities and provide life-saving assistance where it’s needed most.